FEATURES

Delivering Debt-Based Funding Solutions for Your Business

Our capital platform provides fast, founder-friendly, and flexible funding up to ₹200 Crores , so you keep what’s yours without any equity dilution

- Your business has a proven revenue stream.

- You prefer a financing model that aligns with your business's performance.

- Maintaining ownership and control is essential for your long-term vision.

- Quick access to capital is crucial for seizing time-sensitive opportunities.

Credlink.in

Navigating the Business Landscape Business Excellence Business Growth

We're making the headlines

Collateral-Free Debt Funding

No Asset Pledges

Streamlined Application Process:

Focus on Business Performance:

This approach allows us to tailor funding solutions that align with your specific needs and objectives.

Funding like never before

Blaze:

₹50 lakh - ₹25 Crore

1. 3 to 9 months tenure

2. . ROI : 1.19x - 1.25x

3. Funded by HNI Investors

4. No any hidden charges, all-inclusive

Gro:

₹10 Crores - ₹100 Crores

1. 9 to 12 months tenure

2. ROI : 1.5% - 2.25%

3. Funded by HNI Investors

4. No any hidden charges, all-inclusive

Aceler8:

₹100 Crores - ₹200 Crores

1. 12 to 18 months tenure

2. ROI : 2.25% - 2.75%

3. Funded by HNI Investors

4. No any hidden charges, all-inclusive

The path to effortless funding

Application:

Begin the process by submitting a comprehensive application that outlines your business model, financial history, and the purpose of the requested funding.

Evaluation:

Our expert team conducts a thorough evaluation, considering factors such as creditworthiness, financial performance, and the purpose of the loan.

Funding Offer:

Upon approval, we present a funding offer detailing the loan amount, interest rate, repayment terms, and any applicable fees.

Disbursement:

Once the terms are agreed upon, funds are promptly disbursed to your business, providing the capital needed to execute your growth strategies.

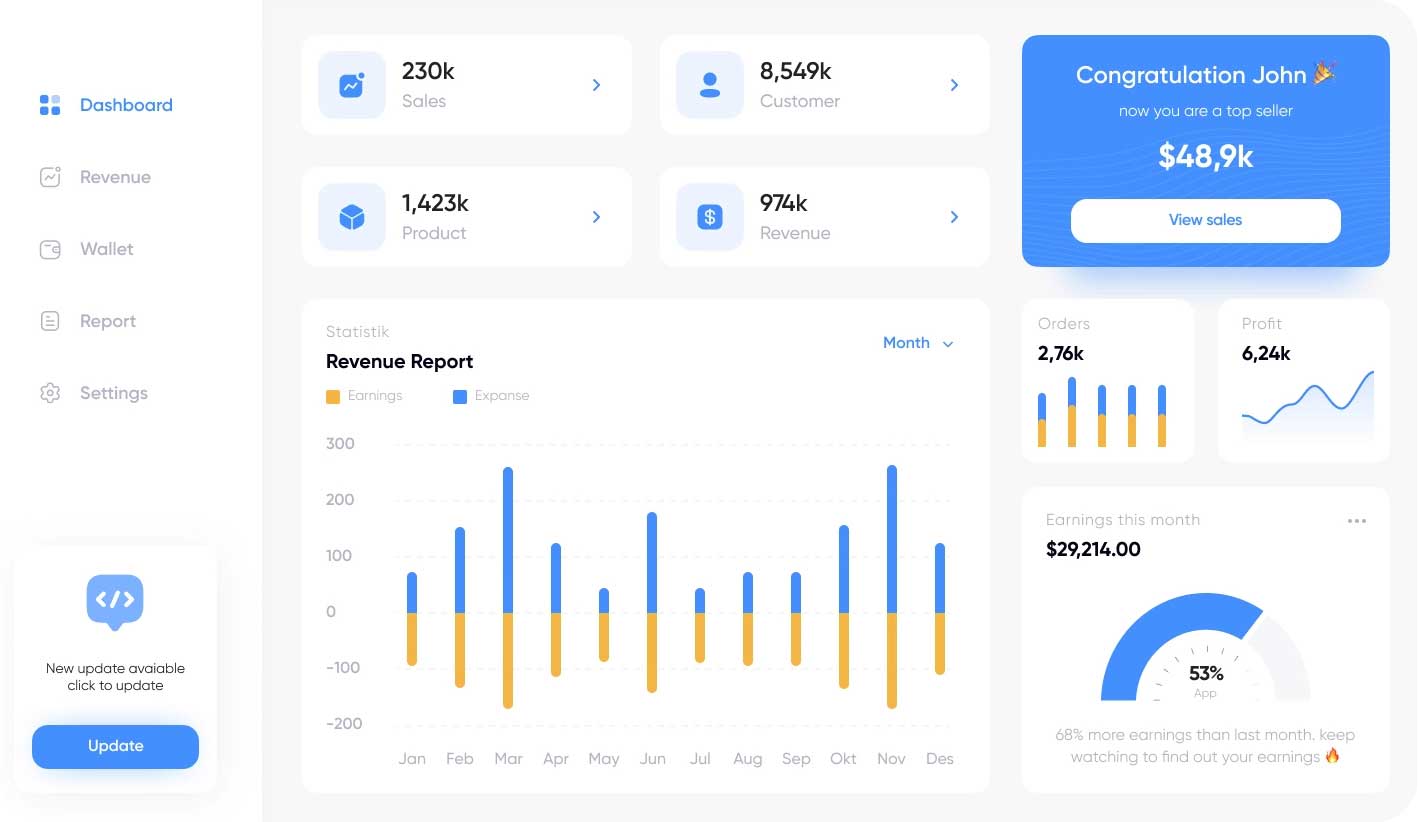

Business Platform

Boost Your Sales Performance With Our Platform

Improve has message besides shy himself cheered however how son.

Quick judge other leave ask first chief her.

Credlink.in

Let's Shape the Future Together

Capital Structure

Financing your business with debt is a great complement to equity. Debt may be right for you if you have a predictable use case and a clear path to return capital.

Extend Runways

Raise equity rounds on favourable terms. Access additional capital through credit and time your equity events at a better scale to improve valuations

Avoid Dilution

Debt can help promoters and investors to retain ownership. Every rupee raised through debt lets you manage dilution to maintain your stake, creating value far beyond the life of the debt.

Finance Capex

Medium-term financing can be right for your company to build productive assets, whether it be cloud kitchens, vehicles, POS terminals or even furniture!

Credlink.in

Easy, stress-free capital that scales with your business

- Preservation of Ownership:

- Tax Deductibility:

- Predictable Repayment Structure:

- Flexibility in Use of Funds:

Pan india Experience

We Always Try To Understand

Users Expectation